2️⃣

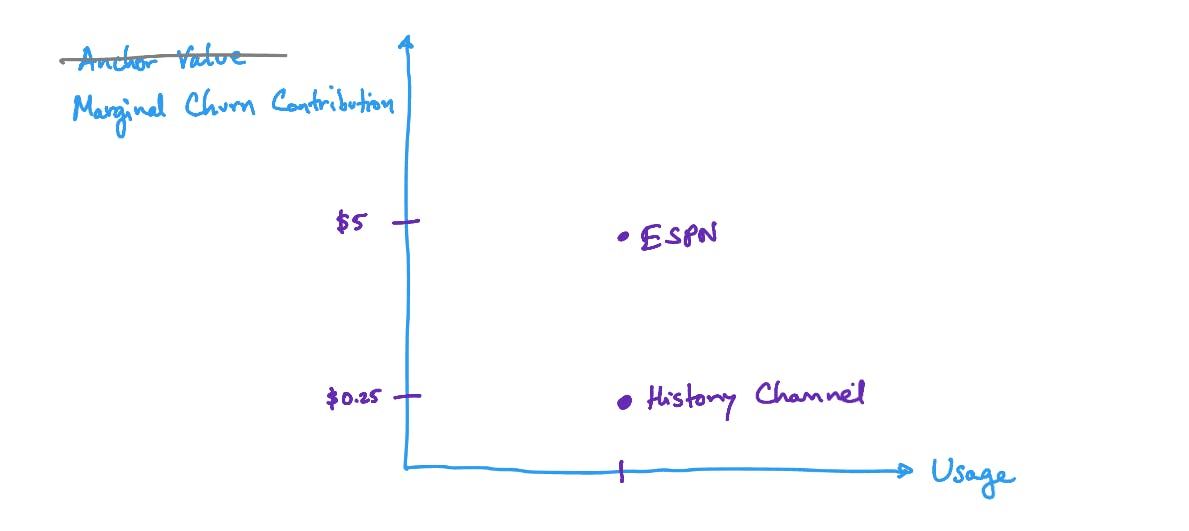

Myth 2. Revenue from bundles should be allocated based on usage

One way to calculate WholesalePrices

Another way to calculate WholesalePrices

Some things I’m leaving out for a separate discussion

A closing example

Next Section: , shift from the provider perspective to the consumer perspective

Want to print your doc?

This is not the way.

This is not the way.

Try clicking the ⋯ next to your doc name or using a keyboard shortcut (

CtrlP

) instead.